- Home

- /

- Govt. Entities

Or visit here for Full website view

Rules for sending bulk communications

Govt entities interested in sending bulk SMS communication, are must follow these steps before sending SMS:

1) Become a registered sender

Register yourself as Principal Entity to send bulk communications to your customers. Learn how to register as sender/Principal entity on TSPs' website

2) Register Header

Every bulk communication is carried through registered headers only. Learn more about the header registration process.

3) Register Content Template

Each header must have at least one content template. Register your content template here

SMS Service Charge Exemption For Government Entities

For messages sent in public interest, Government entities may be exempted from service charges for SMS at terminating telecom operator end. The regulation 35 of TCCCPR, 2018 exempt certain principal entities from these charges upto Rs. 0.05 (five paisa only) for service message.

- ● any message transmitted by or on the directions of the Central Government or State Government.

- ● any message transmitted by or on the directions of bodies established under the Constitution.

- ● any message transmitted by or on the directions of the Authority.

- ● Central Government or State Government

- ● Bodies established under the Constitution Authority

- ● any agency authorized by the Authority from time to time

Regulation 35, TCCCPR 2018

It states that there shall be no Service SMS charge on-

Who is entitled for exemption ?

These entities are:

Accordingly, TRAI may grant exemption from SMS Service charges up to 5 paisa to government entities for sending messages of public interest, on a case to case basis as per the guidelines approved by the Authority from time to time.

The application for exemption shall only be considered after completion of KYC and header registration with any Telecom Service Provider.

Guidelines for 5 Paisa exemption

Guidelines to grant up to 5 paisa exemption on SMS charges with respect to TCCCPR, 2018. Click here to download

Frequently Asked Questions (FAQs)

-

Who can apply for 5 paisa exemption?

Exemption may only be granted to Government bodies mentioned in Regulations 35 of Telecom Commercial Communications Customer Preference Regulations, 2018 (TCCCPR, 2018) i.e. Central Government, State Government and bodies established under the constitution.

-

How to apply for 5 paisa exemption?

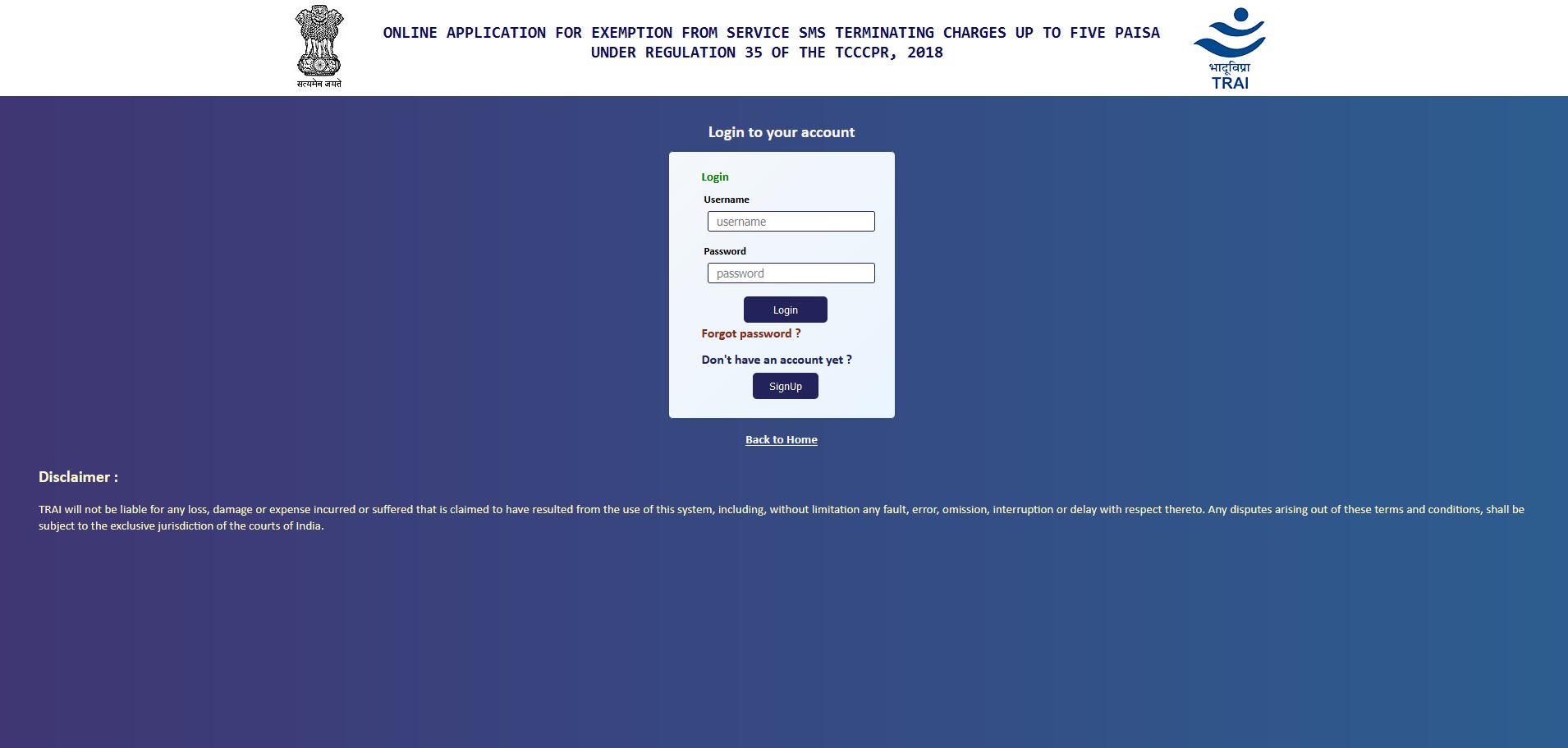

Government Entities may online apply for new exemption or renewal of exemption against the headers registered with TSPs, as per the provisions of TCCCPR 2018.

-

What if the applicant (sender) has not registered the Header for which exemption is requested?

A list of TSP�s DLT registration websites is available within the portal. Applicants can visit any TSP�s website for Entity/header registration. Please note that, according to TRAI direction dated 19.06.2020 regarding implementation of TCCCCPR 2018, the entity registration process will take a maximum of 7 days from the date of submission of all relevant information from the Principal Entity. The header assignment/ registration process after Principal entity registration will take a maximum of 2 days, from the date of submission of all relevant information from the Principal Entity (i.e. Government Entities).

-

Why do I have to mention Purpose of sending a message?

Exemption would be given if the purpose of sending messages is related to sending citizen centric messages and creating awareness for the general public such as messages with regard to campaigns related to Polio, AIDS, Swine Flu, Women Safety etc. No exemption would be given to State or Central Govt departments, who are charging customers for messages or sending messages for commercial purposes.

-

Why is my application rejected?

The possible reasons are -

● Application is incomplete

● You are not covered under the bodies mentioned in Regulation 35 of TCCCPR, 2018.

● Header not registered with Telecom Service provider

● Purpose mentioned in your application does not align with the purpose for granting 5 paisa exemption i.e. messages are not citizen centric and for creating awareness for the general public.

-

Who can apply for 5 paisa exemption?

The period of exemption will depend on the requirement of the sender but shall not be granted for more than one year at a time. Thereafter, the sender needs to request for renewal of exemption. However, in extraordinary cases, the Committee may grant exemption for more than one year after examining the requirement of such header, service description and content of such messages.

-

What is the time band for sending an application for renewal of exemption?

The application for Renewal of exemption would only be considered one month before the expiry of exemption. In case of delay, the sender needs to apply with a new application for exemption.

-

After exemption by TRAI, would I not be required to pay any charge for SMS delivery?

No, you are required to pay the charges for the delivery of messages as per your agreement with TSPs or Telemarketer. As per regulation 35, there shall be service charges up to Rs. 0.05, on the promotional and services messages, which is to be paid to Terminating Access Providers. With the exemption from TRAI, you would not be required to pay this charge (up to 5 paisa) only.